It’s Friday afternoon and I’m anchored down in front of my laptop in beautiful downtown Alexandria, Virginia. My 16-year-old daughter is part of an international entrepreneurship group that is meeting over the next three days, and I’m tagging along as a chaperone.

Foggy Approach into Reagan Airport.

This afternoon, you can feel the US start to downshift a bit as everyone is moving toward the Thanksgiving Holiday. At the same time, the work is full of lots of energy, uncertainty, ambition, and palpable desire for improvement. It’s the same thing that wakes me up every day—the opportunity to make things better.

Ambition is great, but a lack of focus can defeat it.

This week, I stumbled upon the Harada method and found it to be insightful.

Here’s this week’s edition.

-

The Harada Method & The Power of Intentional Days When Building in Wealth Management

-

Next Mile: Mastering the Quarterback Role for Clients 🎧

-

Milemarker On the Road ✈️

The Los Angeles Dodgers are on a historic run — not just because they’ve stacked a roster, but because they’ve anchored their franchise to one of the most disciplined and intentional athletes of our generation: Shohei Ohtani.

You watch him and you see talent, sure — but what you’re actually seeing is architecture: a life structured on purpose.

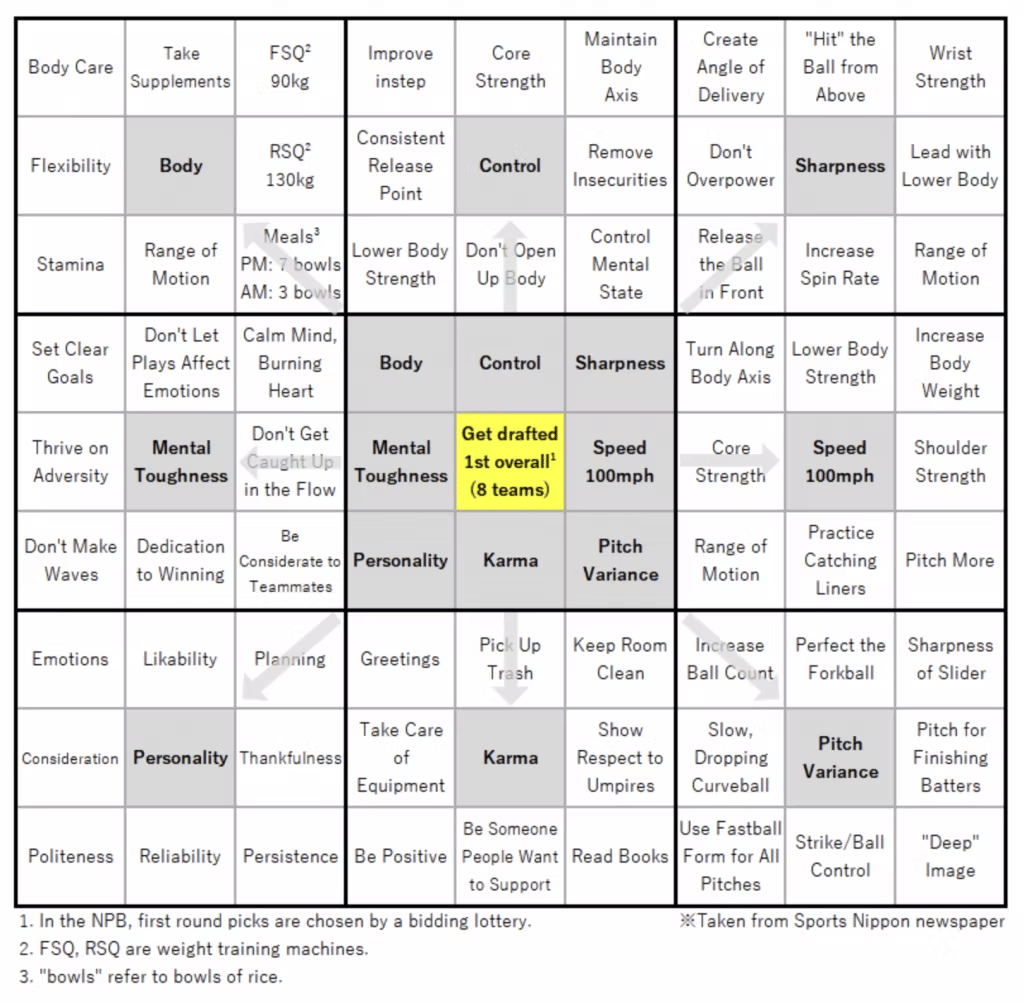

Recently, a chart resurfaced from Ohtani’s early development that revealed he wasn’t simply chasing greatness; he was planning it.

And the system he used wasn’t random. It was the Harada Method, a Japanese framework for self-reliance and goal mastery that many call “the world’s best system for developing people.”

It helped turn a teenager into the most complete baseball player we’ve ever seen.

And it gives us a blueprint for something every leader, advisor, and business needs right now:

A system for prioritization, daily discipline, and intentional growth.

The Harada Method

Because you don’t rise to the level of your goals.

You rise to the level of your systems.

And the Harada Method can give you that system.

Most people and most teams aren’t short on vision.

They’re short on structure.

Big goals? Everyone has those.

But the daily habits?

The scaffolding?

The rhythm that makes progress consistent and predictable?

That’s where we can fall short.

The Harada Method fixes that — and it translates perfectly to how we run our firms, our teams, and our own lives.

1. Set the One Goal

Harada is ruthless about this:

One single priority.

Not five. Not three. One.

“A person with two priorities has zero priorities.”

Your world might require:

-

Build a data-driven advisory firm.

-

Reduce operational drag by 50%.

-

Become the top growth firm in your region.

-

Increase the average client size by 20% in 2026.

Pick one. Own it.

2. Envision the Ideal Future

Describe the world where the goal is achieved:

-

What does your firm feel like?

-

How do clients behave?

-

How does your team operate?

-

Who have you become as a leader?

Clarity turns into fuel.

3. Identify the Required Skills

Harada’s mantra:

Don’t envy excellence — reverse-engineer it.

For advisors or leaders, required skills might be:

-

Data literacy

-

Communication

-

Process discipline

-

Delegation

-

Decision-making

-

Pipeline management

Now your goal is no longer fuzzy.

It’s a skill stack.

4. Build Daily Habits (The 64-Tasks Sheet)

Harada had his students break their goal into 64 micro-habits — small, repeatable actions that create compounding results.

For example:

-

Review the pipeline for 10 minutes.

-

Capture one client insight daily.

-

Improve one workflow weekly.

-

Reduce one inefficiency per day.

-

Review firm data every morning.

-

Coach one advisor weekly.

Greatness lives in tiny daily actions, not heroic bursts.

5. Anticipate Obstacles

This is signature Harada:

List every challenge upfront.

-

“My schedule is packed.”

-

“Our systems are messy.”

-

“People resist change.”

-

“Interruptions steal my day.”

Naming removes the challenge’s power.

6. Identify Your Support System

Harada taught self-reliance, not isolation.

Support includes:

-

Your COO

-

Your CTO

-

Ops

-

Advisors

-

Your tech stack

-

Your spouse

-

Your routines

-

Your mentors

Elite performance happens inside a structure.

7. Establish Personal Standards

This is the cultural engine.

Harada’s students committed to things like:

-

Show up early

-

Never complain

-

Always improve

-

Respect the process

-

Take ownership

For your firm:

-

“We are drivers, not passengers.” (Our number 1 cultural value at Milemarker)

-

“We don’t let clients guess.”

-

“We close the loop.”

-

“We own our numbers.”

-

“We make progress every day.”

Culture is the sum of enforced standards.

Wealth management is in a pressure cooker:

Most firms aren’t failing from lack of compounding.

They’re failing from lack of intentionality.

This is no longer an industry where winging it works.

You need clarity.

You need discipline.

You need a repeatable system.

The Harada Method provides a very solid blueprint.

Imagine every advisor, operator, and leader having:

Now imagine your operations team matching it.

Your leadership matching it.

Your AI workflows matching it.

That’s alignment.

That’s intentionality.

That’s cultural momentum.

This is how teams become dominant.

Shohei Ohtani isn’t a miracle.

He’s a byproduct of structure.

His days are engineered with intention.

His habits are trained on purpose.

His goals are supported by disciplined systems.

Greatness — in any domain — is not spontaneous.

It’s systematic.

The Harada Method is his system.

And it can be ours.

Go Giants & I hope you have a Happy Thanksgiving!

—Jud

Episode 119: On this week’s episode, Kyle Van Pelt sits down with Eric Kittner, CEO and Chairman of the Board at Moneta Group. Eric began his career at Arthur Andersen and RubinBrown before joining Moneta in 2003. Since becoming Managing Partner in 2018, Eric has led Moneta through a period of remarkable growth, expanding from a single Midwest office to multiple national markets and more than doubling its AUM.

Eric talks with Kyle about Moneta’s comprehensive service model and how they’ve operationally mastered the ‘quarterback’ role for clients. He also shares the firm’s geographic growth strategy and the importance of in-office culture for developing the next generation of advisors. From tax strategy to tech adoption to developing next-gen talent, Eric reveals what it really takes to grow a firm that never loses its human touch.

(00:00) – Intro

(03:11) – Eric’s money moment

(05:33) – Lessons from Arthur Andersen: culture, training, and crisis opportunity

(08:10) – How tax strategy shapes Moneta’s approach to serving clients

(09:09) – Building a truly comprehensive service model

(11:39) – Why Moneta has never taken private equity money

(13:43) – Moneta’s intentional growth strategy: Go deep, not wide

(16:16) – What makes a perfect cultural and business fit for Moneta partnerships

(20:50) – Growing next-gen talent through flexibility and connection

(25:11) – Recruiting vs. developing future advisors

(30:30) – How Moneta leverages technology

(33:40) – The biggest tech drag on the advisor experience

(36:31) – Eric’s outlook on the future of wealth management

(40:57) – What makes one RIA different from another

(44:01) – Eric’s Milemarker Minute

Save your seat for Milemarker Navigator’s Launch workshop. We will break down how you can leverage agents on top of any or all of your data without your data risking exposure to anything outside of your Data Engine. This workshop will be educational and help you gain a clear understanding for how you can safely leverage AI in 2026.

Milemarker on the Road

Catch my team on the road at the following events or cities:

-

December 15-16 – Carmel, IN

If you would like to arrange a meeting time, please reply to this email, and we’ll schedule something on the calendar.

Jud Mackrill